Published March 3, 2022 • 3 Min Read

The benefits of getting cash back

Save on school

If you look up college or university in the dictionary, you might see dollar signs dancing around. School can be expensive. When has it not been? That means any extra cash can help you offset the cost of tuition, books, and other fees (because there always are, aren’t there…).Save on entertainment

Life isn’t just about school, it’s about having fun too. Going out with friends to the movies, for dinner, streaming services — it all adds up. For example, getting cash back could help cover the cost of your monthly streaming subscription.Save up for a vacation

Hands up if you need a vacation? Hands up if you need many vacations to make up for lost time? Have you considered the idea of putting cash back you earn toward a vacation fund? Before you know it, your flight down south could be covered.Save long term

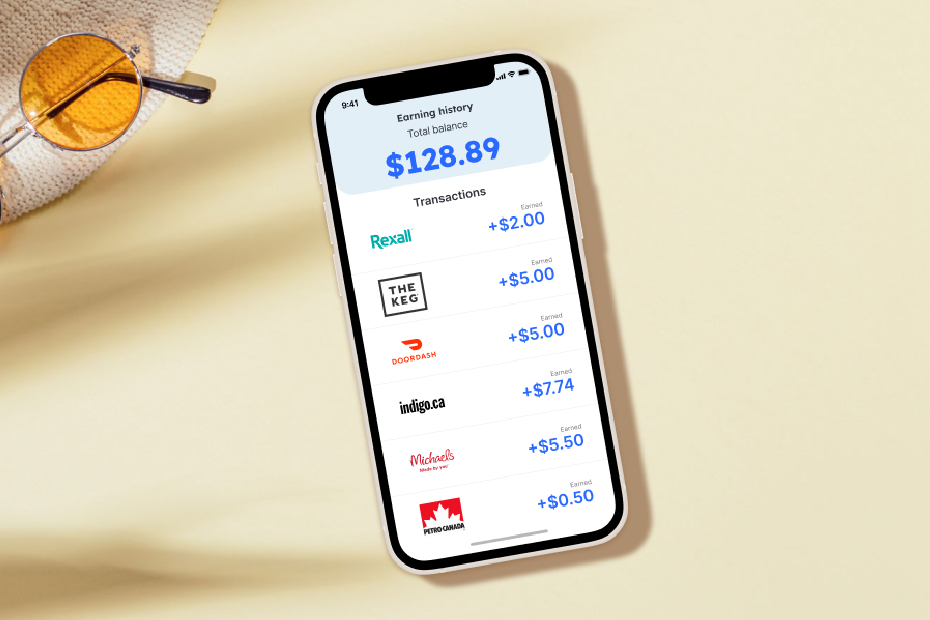

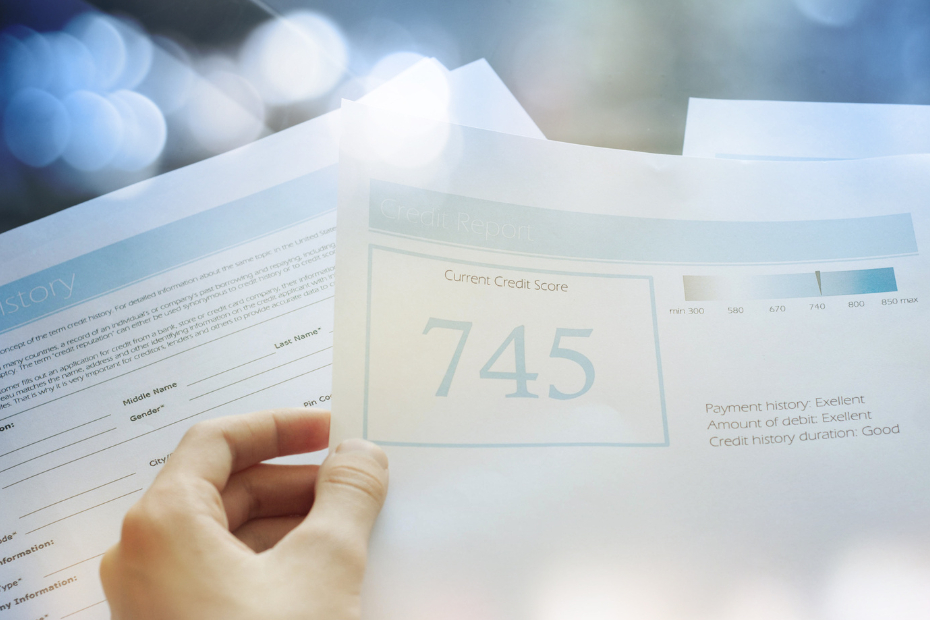

You might think savings shouldn’t be on your radar this young — but think again. It’s never too early to start considering your long-term goals, including retirement. From savings accounts to investments, there are a multitude of ways you can turn the cash back you get into long-term savings. Even small amounts can turn into bigger savings down the road. Ok, so how can you actually earn cash back? One is super simple way is with a free cash back app like Ampli where you earn cash back on your everyday purchases. For students, this could be a no-brainer: You’re already spending money on food, clothing, books, ride-sharing, streaming services — why not get cash back? Best of all, once you connect your cards, Ampli will automatically match in-app offers with your purchases. So while you’re busy studying or “studying,” you’ll be making bank in the background.Ready to graduate to cash back? Download the free Ampli app from the App Store or Google Play. No loose change required.

Guess what? RBC wants to help you kickstart your cash back. Get an instant $20 when you download and register for Ampli using code STUDENT20 and connect your first debit or credit card.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article