Latest Articles

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Just because you’ve been doing things one way for years, doesn’t mean you have to keep doing them that way. With the software and apps available…

Take Our Quiz To Find Out Your money mindset affects your ability to save and invest with confidence. Find out how it influences the way you think…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

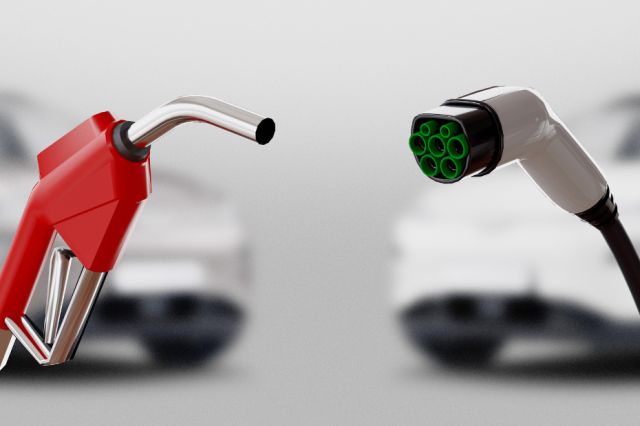

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Learn the common dangers kids face online, how to keep them safe and conversation starters to keep the lines of communication open.

For Canadians looking for a warm-weather retirement destination, Central Florida offers loads of options in an affordable environment.

Today's top 3 fraud scams and how to protect your business, your data and your finances.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Strategies to help individuals who want to avoid personal bankruptcy.

A consumer proposal can make it easier to manage debt to become debt-free, but it may take a toll on your credit score.

Having a support team you can turn to during financially stressful times is important. Have you thought about who to include?

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Considering a consumer proposal or bankruptcy to deal with debt? Here are the main benefits — and challenges — to know for each one.

Use these strategies to rebuild your credit after bankruptcy. It takes time and effort, but improving your credit score is entirely doable.

A closer look at impulse buying, as well as reasons why people over-shop and what to do to better control spending.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Check out these highly responsible—yet possibly boring—things to do with your hard-earned bonus.

It can feel like you're an air traffic controller trying to monitor where everything is coming and going and sometimes you slip up.

Here's a few reasons why talking about money actually helps to reduce your worries about it.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Before buying an eBike, here are some of the key things to consider for making your purchase.

How to choose the most fuel-efficient vehicle to meet your daily needs, save you money and help the environment.

Parting ways with your current vehicle? Here's what you need to know about trading in versus selling it yourself.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

3 tips for navigating the car buying process with confidence.

Find the right car for you: Four factors to consider when deciding between a new or used vehicle.

EVs promise to transform the transportation sector, drive job creation, and reduce national greenhouse gas emissions.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

2020-2021 gap year resources to help you have fun and keep learning.

Jayne's Cottages founder shares how she built a network of 200+ luxury cottage rentals on trust, service and attention to detail.

A home equity line of credit may be a way for you to access U.S. cash from your U.S. property.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

If a loved one dies with outstanding debt, who's responsible for it? Learn how debt is managed after death and what your role might be.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

How do you teach your kids about money matters? Integrate financial literacy into your everyday life with these tips.

Tips to help you support kids as they start to learn about money matters and saving for their goals.

Divorce is rarely easy — the emotional and financial fallout can be tough. But it can offer an opportunity for a fresh start.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Part 3 of Your Journey as an International Student in Canada: Jobs and Money

How to set yourself up for success in your first week as a new international student in Canada.

5 tips to prepare for school in Canada as an international student before you arrive.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Cyber crime can have a significant impact on your business. Discover resources to boost your cyber security.

Cybercrime is on the rise and affecting business owners across Canada. Experts share current threats and ways to help protect your business.

The average person has to remember about 100 passwords. Here are tips to keep your passwords strong, memorable and organized.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Email scams can affect anyone. But you can protect yourself with these four simple tips.

Understanding the different types of borrowing options can help you determine if one is right for you.

A scarcity mindset isn't necessarily a reflection of your actual financial reality, but rather a pattern of thought that can be changed.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

How to defend yourself today against 5 common scams targeting Canadians.

Electric vehicles (EVs) have come a long way since 2011 when they first became available on the Canadian market.

Stay cozy while saving money on your energy bills and reducing your household greenhouse gas emissions.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Just because you’ve been doing things one way for years, doesn’t mean you have to keep doing them that way. With the software and apps available…

Political cartoonist Andy Donato shares his remarkable story in front of a live audience.

Dr. Eric Weissman has been studying homelessness for nearly 25 years, following his own period of homelessness and addiction.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

If you're thinking of starting a business or looking to grow, let these stories inspire you to make your next move.

The new RBC Small Business Poll reveals Canadians are turning to entrepreneurship to fulfill financial, career and life aspirations.

Hear from franchising experts on what it takes to get started and succeed as a franchise owner.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

RBC webinar panelists discuss why it's important for businesses to be online, how to get started and how to maximize your presence.

Looking to grow your business? Check out these grants and funding opportunities that can help support your growth strategy.

As you close the books on 2022, this checklist can help you shore up your business so you're better prepared to take on the year ahead.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Simplify your daily routines and save some money with these ah-mazing packed lunch ideas for all ages.

Spruce up your living space with these simple updates that are both stylish and sustainable.

We speak with an expert to find out if there's a perfect time to get into the markets.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bryan and Sarah Baeumler Share 5 Tips on Starting and Growing a Business

[Webinar] Bryan and Sarah Baeumler discuss their struggles, wins and lessons learned while starting and growing their businesses.

-

5 Home Buying Mistakes to Watch Out For: Tips From Bryan and Sarah Baeumler

Bryan and Sarah Baeumler share the most common mistakes they've seen home buyers make — and confess a few of their own.

-

Kids Away at School? Remind Them of These Financial Pitfalls

To help prevent costly mistakes, it can't hurt to pass along a few words of financial wisdom.

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

We've got a simple answer to this age-old question about retirement.

One expert busts three common myths about guaranteed investment certificates.

Having early money talks with our kids can prepare them for tougher financial realities.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Treat yourself (or someone special) to a fancy French meal that is homemade and delicious without breaking the budget.

The Canadian government has introduced a new registered account aimed at first-time homebuyers. Here's what to know about it.

Positive Canadian inflation trends persist in December, says RBC Economics.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.