Latest Articles

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Just because you’ve been doing things one way for years, doesn’t mean you have to keep doing them that way. With the software and apps available…

Take Our Quiz To Find Out Your money mindset affects your ability to save and invest with confidence. Find out how it influences the way you think…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

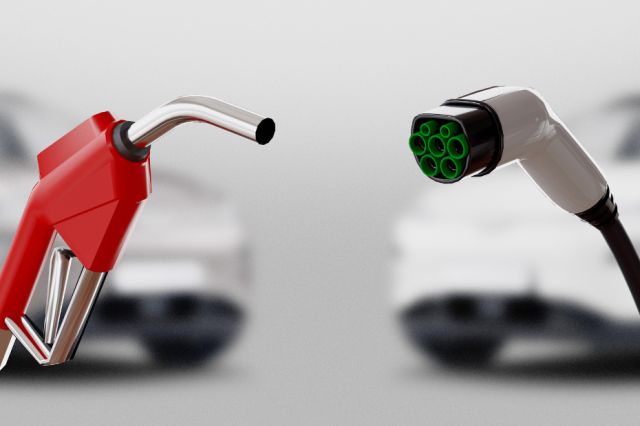

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

If you're planning an extended trip, these tips can help you manage your money while you're away from home.

A scarcity mindset isn't necessarily a reflection of your actual financial reality, but rather a pattern of thought that can be changed.

Should you buy or rent your vacation home? Help in deciding which one works for you.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Strategies to help individuals who want to avoid personal bankruptcy.

A consumer proposal can make it easier to manage debt to become debt-free, but it may take a toll on your credit score.

Having a support team you can turn to during financially stressful times is important. Have you thought about who to include?

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Considering a consumer proposal or bankruptcy to deal with debt? Here are the main benefits — and challenges — to know for each one.

Use these strategies to rebuild your credit after bankruptcy. It takes time and effort, but improving your credit score is entirely doable.

A closer look at impulse buying, as well as reasons why people over-shop and what to do to better control spending.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

5 tips to help you leverage debt for growth and manage it efficiently through today's evolving economy.

Money expert Kumiko Love shares how a bit of honesty can elevate budgeting from an act of self-sacrifice to one of empowerment.

Is a tax refund in your future? If so, we've got some savvy tips for what you could do with it.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Before buying an eBike, here are some of the key things to consider for making your purchase.

How to choose the most fuel-efficient vehicle to meet your daily needs, save you money and help the environment.

Parting ways with your current vehicle? Here's what you need to know about trading in versus selling it yourself.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

3 tips for navigating the car buying process with confidence.

Find the right car for you: Four factors to consider when deciding between a new or used vehicle.

EVs promise to transform the transportation sector, drive job creation, and reduce national greenhouse gas emissions.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

EVs promise to transform the transportation sector, drive job creation, and reduce national greenhouse gas emissions.

5 tips to help you maximize the mileage on your EV.

Has your home increased in value over the last few years? If so, now might be a good time to refinance and put that equity to work for you.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

If a loved one dies with outstanding debt, who's responsible for it? Learn how debt is managed after death and what your role might be.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

How do you teach your kids about money matters? Integrate financial literacy into your everyday life with these tips.

Tips to help you support kids as they start to learn about money matters and saving for their goals.

Divorce is rarely easy — the emotional and financial fallout can be tough. But it can offer an opportunity for a fresh start.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Answers to the top questions Canadians have about owning an EV.

Who will manage your finances if you can't? Powers of attorney are an essential part of your estate plan.

One year in, and Go-To Grandma is a hit with listeners. Here are the top financial tips rounded up after a year on the air.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Cyber crime can have a significant impact on your business. Discover resources to boost your cyber security.

Cybercrime is on the rise and affecting business owners across Canada. Experts share current threats and ways to help protect your business.

The average person has to remember about 100 passwords. Here are tips to keep your passwords strong, memorable and organized.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

Email scams can affect anyone. But you can protect yourself with these four simple tips.

Understanding the different types of borrowing options can help you determine if one is right for you.

A scarcity mindset isn't necessarily a reflection of your actual financial reality, but rather a pattern of thought that can be changed.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

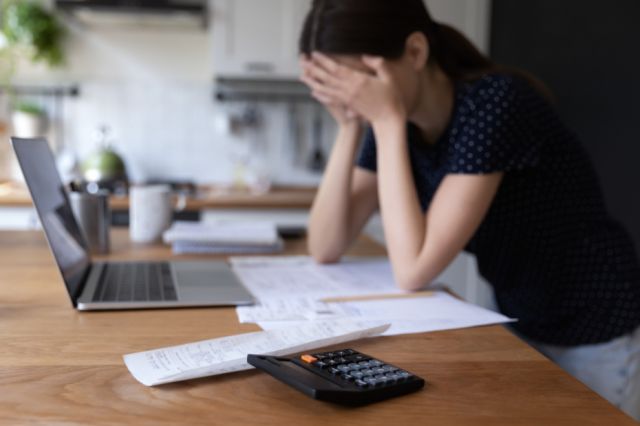

Should you pay down debt or save? With the right debt management strategy, it's possible to do both to reach your financial goals.

If your credit score is suffering due to missed payments, or mounting bills and debt, there are steps you can take to get back on track.

A closer look at money and emotions: How money worries can affect Canadians from all walks of life.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Just because you’ve been doing things one way for years, doesn’t mean you have to keep doing them that way. With the software and apps available…

Political cartoonist Andy Donato shares his remarkable story in front of a live audience.

Dr. Eric Weissman has been studying homelessness for nearly 25 years, following his own period of homelessness and addiction.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

If you're thinking of starting a business or looking to grow, let these stories inspire you to make your next move.

The new RBC Small Business Poll reveals Canadians are turning to entrepreneurship to fulfill financial, career and life aspirations.

Hear from franchising experts on what it takes to get started and succeed as a franchise owner.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Learn how to use social media to your advantage as experts share tips, trends and best practices in this RBC Small Business Talks webinar.

For many businesses, preparing for a net-zero future may involve reviewing their growth strategy, purpose, and values.

Discover podcasts to help business owners navigate today's ever-changing environment and be ready to win for tomorrow.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Simplify your daily routines and save some money with these ah-mazing packed lunch ideas for all ages.

Spruce up your living space with these simple updates that are both stylish and sustainable.

We speak with an expert to find out if there's a perfect time to get into the markets.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bryan and Sarah Baeumler Share 5 Tips on Starting and Growing a Business

[Webinar] Bryan and Sarah Baeumler discuss their struggles, wins and lessons learned while starting and growing their businesses.

-

5 Home Buying Mistakes to Watch Out For: Tips From Bryan and Sarah Baeumler

Bryan and Sarah Baeumler share the most common mistakes they've seen home buyers make — and confess a few of their own.

-

Kids Away at School? Remind Them of These Financial Pitfalls

To help prevent costly mistakes, it can't hurt to pass along a few words of financial wisdom.

Windfall!

If you came into $10,000 today, what would you do first?

- Pay down debt/ pay bills (33.33%)

- Invest it towards a longer-term goal (33.33%)

- Go on Vacation (0%)

- Buy something for myself (33.33%)

- Shower friends & family with gifts (0%)

We've got a simple answer to this age-old question about retirement.

One expert busts three common myths about guaranteed investment certificates.

Having early money talks with our kids can prepare them for tougher financial realities.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Find out about the bandwagon effect and how it can skew your decisions.

Why a Montreal-based freelancer credits her father for putting her on solid footing when it comes to money.

Ready to earn some passive income? Here are the basics of creating regular cash flows from investments without breaking (too much of) a sweat.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.